Are you struggling for a deposit or just wondering about the different options for homeownership?

This guide will walk you through the ins and outs of Rent to Buy, a scheme designed to bridge the gap between renting and owning a home.

What is Rent to Buy?

Rent to Buy is a way to help people move from renting to owning a home. In England and Northern Ireland, you can rent a new home for less money than usual. You save about 20% on rent. You can use this saved money to help buy the house later. You have up to five years to decide if you want to buy the house or part of it. If you don’t buy, you have to move out.

In Wales, the plan is a bit different. You pay regular rent for up to five years. After two years, you can choose to buy the house. If you buy, you get back 25% of the rent you paid and half of any increase in the house’s value. This money helps you buy the house.

There’s no Rent to Buy plan in Scotland right now.

Different names like “Rent to Save” or “Rent to Own” are used for this plan, but they mostly mean the same thing. The rules can vary a bit depending on the housing group that offers the house.

How Does Rent to Buy Work?

Rent to Buy is a scheme designed to make the transition from renting to owning a home easier and more affordable. Here’s how it generally works:

- You rent a home at 80% of the usual rent cost.

- The lower rent helps you save money for a future deposit.

- You usually get the first chance to buy the home after two years of renting.

- The rental period can last from six months to five years.

- If you don't buy by the end of the rental period, you have to move out.

- You can choose to buy part of the home through shared ownership if you can't afford the whole thing.

- The number of available homes in this scheme is limited and varies by area.

How Much can I Save with Rent to Buy?

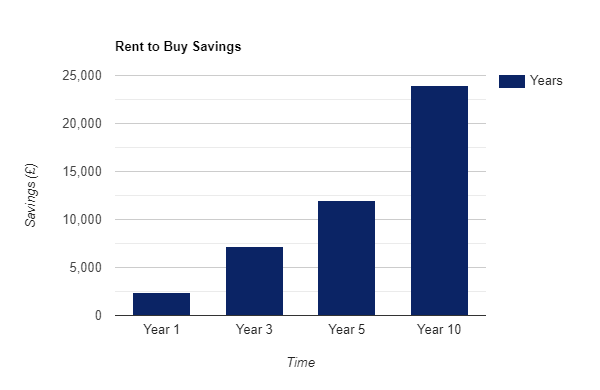

In Rent to Buy, you usually pay about 80% of what you’d pay for regular rent. Here’s an example to show how much you could save:

- Market rent: £1,000 a month

- Rent to Buy rent: £800 a month

- Savings: £200 a month

- Three Years Savings: £7,200 plus interest

- Five Years Savings: £12,000 plus interest

Can I get Rent to Buy?

You can participate in Rent to Buy if you meet the eligibility criteria set for your area.

However, it’s not just about renting; you’ll also need to qualify for a mortgage to eventually buy the property. If the landlord decides to sell the property while you’re renting, you get the first option to buy it.

Keep in mind that the property’s value may have changed—either increased or decreased—since you first moved in.

Before making any decisions, it’s a good idea to compare different mortgage options to make sure you can afford the loan you’ll need to buy the home.

EXPERT ADVICE

Check Your Credit Score

A good credit score will be crucial when you apply for a mortgage later. Make sure it’s in good shape.

Should I Do It?

Deciding to go for Rent to Buy depends on a few things. First, check if you’re eligible. Then look at the details of the offer from the housing association. Offers can vary a lot, so read the fine print carefully. Ask yourself if you’ll really use the lower rent to save for a deposit.

If you decide to go ahead, try to cut costs in other areas too. This will help you save more money for the deposit. There are guides available that can help you reduce your bills and plan a budget.

Before you commit, talk to an independent mortgage adviser. They can help you understand what your monthly payments might be if you buy the property. Also, check if mortgage lenders are okay with Rent to Buy properties. Don’t forget, buying a home has other costs too, like fees and taxes. Make sure you can afford all of it.

Bar chart assumes monthly savings of £200 from the Rent to Buy scheme

Pros and Cons of Rent to Buy

Before diving into Rent to Buy, it’s important to weigh the pros and cons.

Here’s a detailed look at the advantages and disadvantages to help you make an informed decision.

Pros

- Lower rent helps you save for a deposit.

- Access to homes you might not afford otherwise.

- Live in the home first to get a feel for it and the community.

- First chance to buy, so no one else can buy it before you.

- Option for shared ownership.

- Dealing with a social landlord may give extra security.

Cons

- House prices may rise, making it too expensive to buy later.

- You may need to join a waiting list.

- Scheme not available everywhere.

- If you use shared ownership, selling later can be harder.

- Rent is not entirely 'dead money,' but you still don't own the property yet.

- Limited choice of homes.

Final Notes

We hope this guide has provided you with a clear understanding of the Rent to Buy scheme and how it could potentially benefit you. Whether you’re eager to move into a home of your own or simply exploring your options, Rent to Buy offers a unique approach to homeownership.

Key Takeaways to Remember:

- Financial Flexibility: Rent to Buy allows you to save for a deposit while living in the property.

- First Dibs: You get the first chance to buy the property, eliminating competition from other buyers.

- Know Before You Own: Living in the property first gives you a better sense of the home and community.

- Expert Advice: Always consult with professionals like mortgage advisers to make informed decisions.

- Read the Fine Print: Each housing association has different terms, so make sure you understand them.

Remember, everyone’s situation is different. Take the time to assess your own needs, consult with professionals, and weigh the pros and cons before making your decision.

James - Financial Enthusiast

James is a dedicated financial enthusiast. With a deep passion for financial analysis and investment strategies, he brings a unique perspective to his role in property development.